Week Oct 25, 2024

Fixed Income

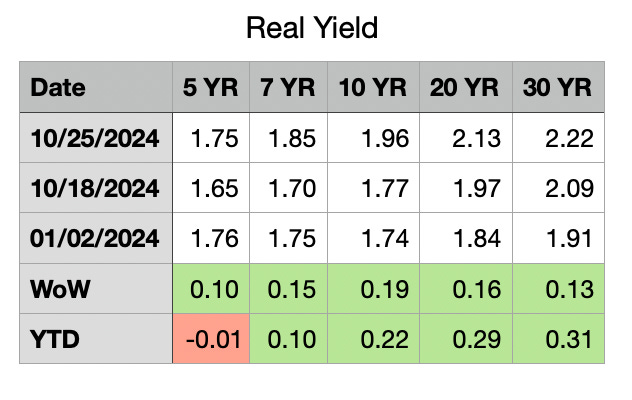

Initial Jobless claims dropped. Longer term bond yields continue to rise as market bets odds of pro growth and pro inflation fiscal policy from the next administration along with the Fed’s monetary decision of cutting 50 bps into a still growing economy (low jobless claim, strong retail sales, low unemployment rate, and positive consumer sentiment. Higher fiscal debt and interest on the debt also discouraged investors from investing in the longer term bonds and thus driving up yields.

Equity

Strong TSLA earnings helped to slightly lift the major index.

Election uncertainty keeps VIX elevated.

Next Week

PCE

GDP

Treasury Refunding Announcement

Multiple Earnings Calls

Market Outlook

Keep reading with a 7-day free trial

Subscribe to Finance Ninja to keep reading this post and get 7 days of free access to the full post archives.