Week Jun 27, 2025

The week started with US attacking Iran’s nuclear sites and the week ended with Equity at All time high. President Trump’s decision in involving with the Israel-Iran conflict demonstrates US’s influence over the global world order. The involvement highlights the US’s technological and military power.

Moreover, talks about the Big Beautiful Bill being discussed over the Senate and aiming to be passed sometime before 4th of July if not then Labor Day gives the market another positive event to look forward to.

In addition, Fed Chair Powell went through a 2 day testimony at the Senate. A few q’s came from the Senate involving higher rates’s impact on the Housing Market (Mortgage and Construction of Supply of new Homes). Powell’s take is rates likely won’t have an impact on the supply of homes while Congress pushes back as they think higher rates discourages homebuilders from building more homes. Powell thinks more in the Aggregate as he indicates that higher rates help to dampen inflation and pushes overall prices down. He even brought up a few data points such as rent and owner’s equilvalent rent, indicating drops in those datapoints.

The Federal Open Market Committee voted 5-2 to lower Supplemental Leverage Ratio from 5% to (3.5% / 4.5%). This is a ratio that applied to banks after the Great Financial Crisis; it required banks to hold more reserves dependent on the size of their loans instead of the debt rating.

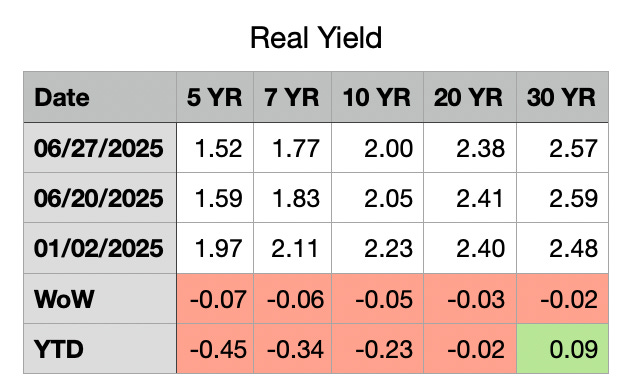

The higher SLR means the banks have to hold more reserves regardless of the risk of the assets (i.e. Treasury vs Corporate Debt). By lowering the SLR, banks may be inclined to hold more Treasury. Indeed, bond yields dropped this week.

Another historical example we can look at is during the 2020 to 2021 years. The Fed removed the Treasury holdings as a weight of the assets from the calculation of the SLR, and this opened up banks room to buy into Treasuries since it won’t impact their Supplemental Leverage Ratio.

On the equity side, the financial sector stocks rallied this week as the market sees the lower SLR freeing up capital for banks to deliver cash back to shareholders.

Weekly Jobless claims still did not spike much while continuing claims continue to rise.

Trump to nominate a Fed Chair soon. This Shadow Fed Chair can help expedite Trump’s wish of lower rates as the market will start putting more weight to the upcoming Fed Chair’s communications. Trump can simply nominate a dovish Fed Chair and the market will put into the forecast of lower rates in the future. A few members of the Federal Open Market Committee have started to sound dovish, likely trying to gain Trump’s attention and likelihood of getting nominated.

GDP report shows GDP contracted by 0.5% in Q1 2025. The contraction was driven by lower consumer spending and a surge in imports.

PCE indicates consumer slow down while inflation stays high, a stagflation scenario.

Personal Income declined 0.4%

Personal Spending declined 0.1%

Core PCE rose 2.7%

Core PCE rose 0.2%

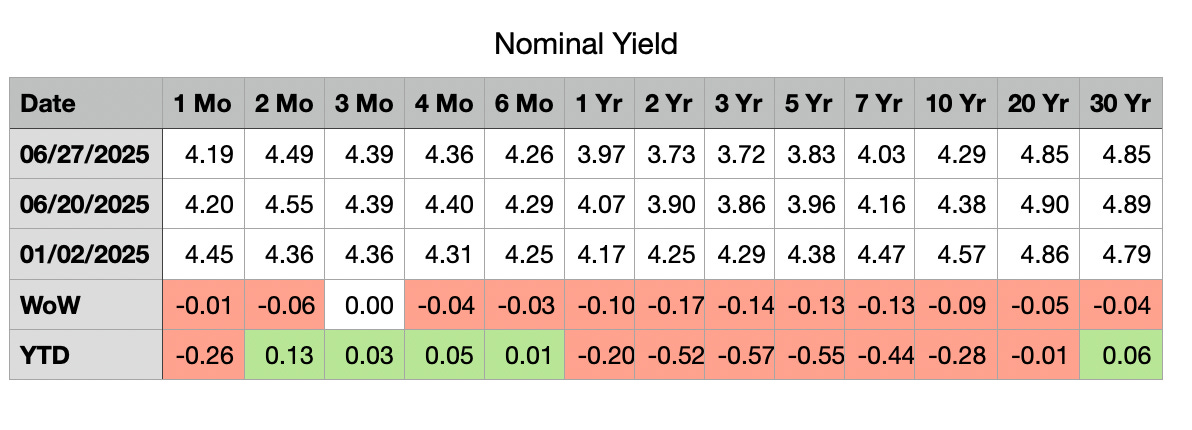

Fixed Income

Rates in the belly of the curve dropped this week as investors pile into the 2 year to 10 year Treasuries. This indicates the market wants some duration in anticipation of a slowing economy or perhaps an economic downturn that requires the seeking of safe haven in US Treasury. This reaction shows USD’s safe haven status remains. The longer term bonds such as 20 year and 30 year shows yields dropped less, indicating the market’s fear of inflation in the US.

Equity

With the geopolitical tensions coming to a resolution, the Big Beautiful Bill making progress, Bank Regulations such as SLRs being loosen up, Trumps’ indication of a Fed Chair and a few members of the Federal Open Market Committee turning dovish. The market ripe.

Next Week

PMI

Jobless Claims

Market Outlook

Keep reading with a 7-day free trial

Subscribe to Finance Ninja to keep reading this post and get 7 days of free access to the full post archives.