Week Jul 19, 2024

Fixed Income

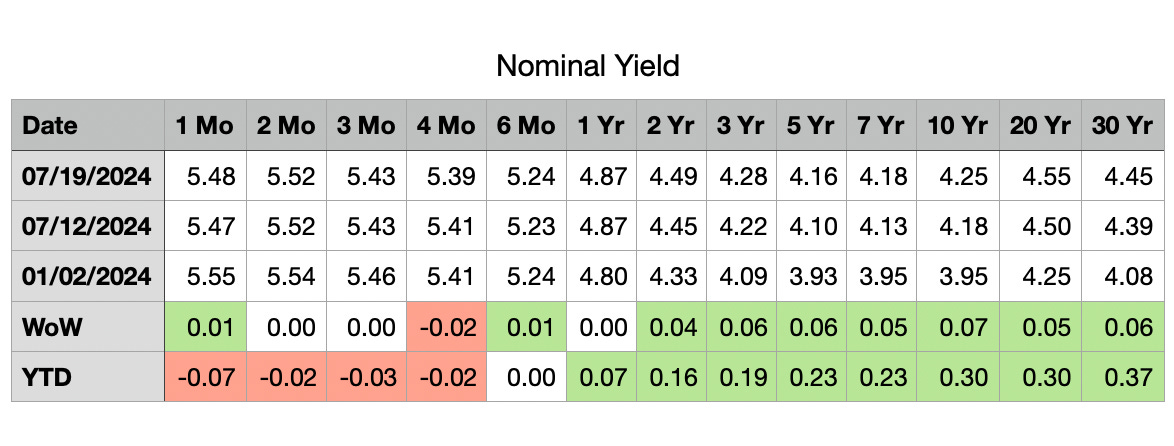

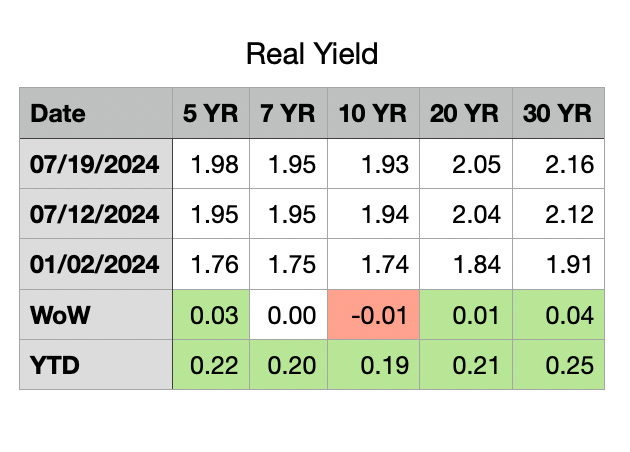

Nominal yield jumped, especially on the longer tenor. Yield curve dis-inverting. 2 yr to 10 yr spread the least inverted it has been. 2 yr -30 yr almost flat. The bond market is pricing in a higher probability of Trump winning the election and predicting a higher growth and wider deficit, so the longer tenor rates are rising.

Equity

SPY down 2.35% this week. VIX jumped due to election uncertainty from the Democratic candidate along with global tech outage. People looking for a reason to sell and found it. Small caps rally. Rotation to small caps begin.

Next Week

GDP

PCE

Market Outlook

Keep reading with a 7-day free trial

Subscribe to Finance Ninja to keep reading this post and get 7 days of free access to the full post archives.