Week Aug 1, 2025

Fed Didn't Cut Rate, Two Days Later, Jobs Report Tells It To,

This week was packed with market moving events.

Fed Meeting: Hawkish Tone, No Rate Cut → Rates Rise After

Meta and Microsoft Earnings: Report shows signs of AI investment paying off → Stocks Up After

PCE Report: Tariff Impact Began to Spill Into PCE → Fed Fund Futures Expect Rate Cut Delay

Jobs Report: Came In 73K Jobs Added, Expected to be 104K. Previous two months revised down - > Rates Dropped 20 bps after! Labor Force Participation Rate also dropped, meaning the unemployment rate would’ve been higher had more people participated in the work force.

Additionally, ISM number came out worse than expected. Consumer sentiment worse than expected. Inflation expectation higher than expected.

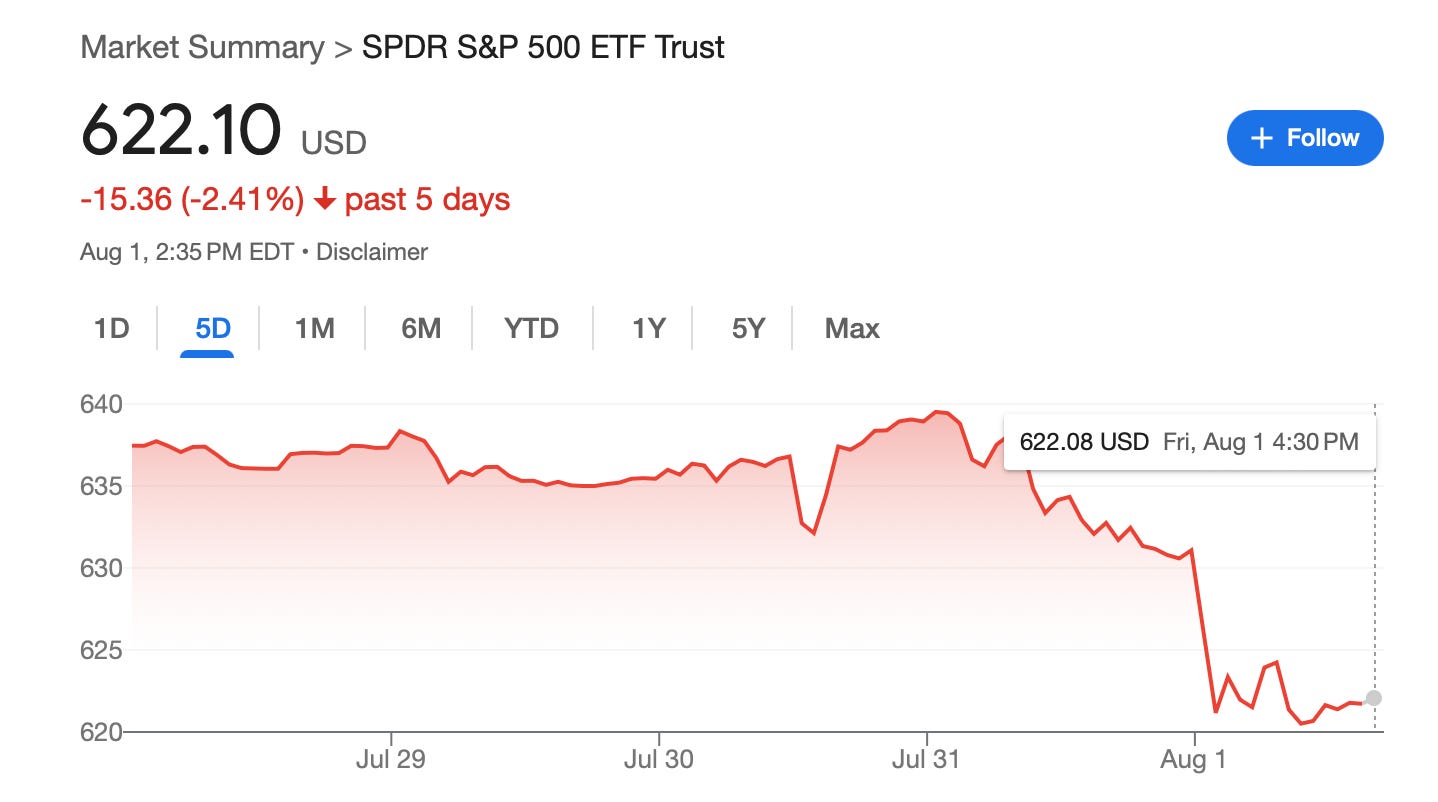

Basically, everything that happened before Friday was reversed by that Jobs Data.

The FOMC meeting on Wednesday shows 2 Fed Governor Dissented from consensus. They were pushing for a 25 bps rate cut. This has never happened since 1993. Those two that dissented in 1993 were right. After Friday’s jobs report, Bowman and Waller were vindicated in voting for a rate cut.

Given the stickiness in the PCE data, the Fed is in a catch 22 place. They either have to cut to save the jobs market, or keep rates elevated to fight PCE until inflation truly falls to their 2% target.

Big Tech Earnings reinforced the idea of AI spending leading to positive impact on the companies margin. Companies are able to reallocate spending into technology in lieu of human capital, helping to increase productivity and lower workforce expenses. These companies grew their top line while keeping headcount flat or lower.

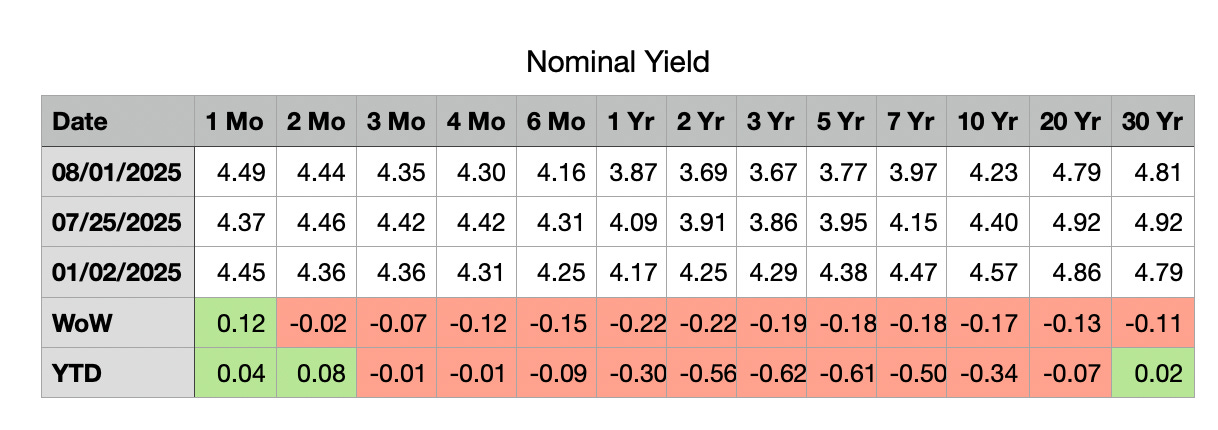

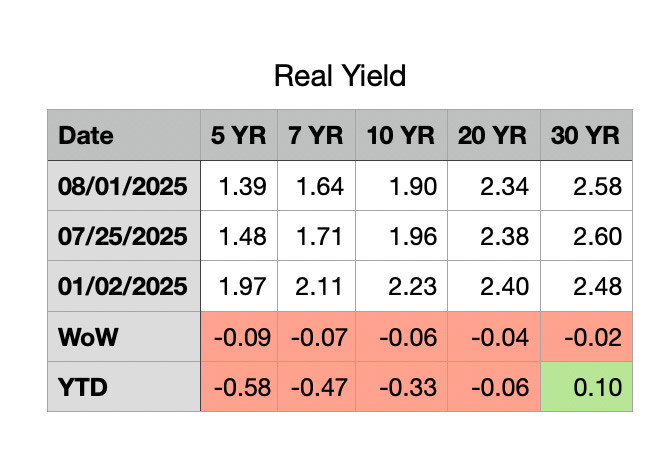

Fixed Income

Yields dropped across the curve after this gloomy jobs report.

Equity

Stocks reversed course and dropped.

Next Week

More Earnings

Less Data

Some Fed Speak

Some Data Points

Maybe some updates on Trade

Market Outlook

Keep reading with a 7-day free trial

Subscribe to Finance Ninja to keep reading this post and get 7 days of free access to the full post archives.